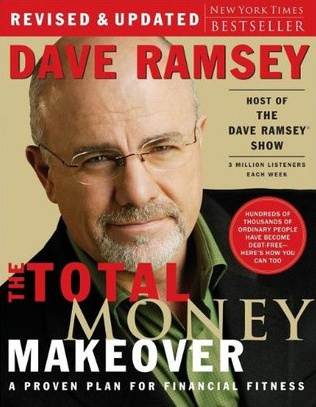

Dave Ramsey · 223 pages

Rating: (48.5K votes)

“We buy things we don't need with money we don't have to impress people we don't like.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“For your own good, for the good of your family and your future, grow a backbone. When something is wrong, stand up and say it is wrong, and don't back down.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Change is painful. Few people have the courage to seek out change. Most people won’t change until the pain of where they are exceeds the pain of change.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“You must walk to the beat of a different drummer. The same beat that the wealthy hear. If the beat sounds normal, evacuate the dance floor immediately! The goal is to not be normal, because as my radio listeners know, normal is broke.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Years ago, in a motivational seminar by the master, Zig Ziglar, I heard a story about how mediocrity will sneak up on you. The story goes that if you drop a frog into boiling water, he will sense the pain and immediately jump out. However, if you put a frog in room-temperature water, he will swim around happily, and as you gradually turn the water up to boiling, the frog will not sense the change. The frog is lured to his death by gradual change. We can lose our health, our fitness, and our wealth gradually, one day at a time. It might be a cliché, but that’s because it is true: The enemy of “the best” is not “the worst.” The enemy of “the best” is “just fine.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Aristotle once said, “To avoid criticism say nothing, do nothing, and be nothing.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Winning at money is 80 percent behavior and 20 percent head knowledge. What to do isn’t the problem; doing it is. Most of us know what to do, but we just don’t do it. If I can control the guy in the mirror, I can be skinny and rich.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“The enemy of “the best” is not “the worst.” The enemy of “the best” is “just fine.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“I tell everyone never to take more than a fifteen-year fixed-rate loan, and never have a payment of over 25 percent of your take-home pay. That is the most you should ever borrow.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“It is human nature to want it and want it now; it is also a sign of immaturity. Being willing to delay pleasure for a greater result is a sign of maturity.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“A budget is people telling their money where to go instead of wondering where it went.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Someone who never has fun with money misses the point. Someone who never invests money will never have any. Someone who never gives is a monkey with his hand in a bottle.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“typical millionaire lives in a middle-class home, drives a two-year-old or older paid-for car, and buys blue jeans at Wal-Mart.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Savings without a mission is garbage. Your money needs to work for you, not lie around you.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“The lottery is a tax on poor people and on people who can’t do math. Rich people and smart people would be in the line if the lottery were a real wealth-building tool, but the truth is that the lottery is a rip-off instituted by our government. This is not a moral position; it is a mathematical, statistical fact. Studies show that the zip codes that spend four times what anyone else does on lottery tickets are those in lower-income parts of town. The lottery, or gambling of any kind, offers false hope, not a ticket out.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“The reality is that Murphy doesn’t visit as much, but when he does, we hardly notice his presence. When Sharon and I were broke, our heating-and-air system quit, and the repair cost $580. It was a huge, hairy deal. Recently I had a new $570 water heater installed because the old one started leaking, and I hardly noticed. I wonder if the stress relief that your Total Money Makeover provides will allow you to live longer?”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“one reason to have a Total Money Makeover is to build wealth that allows you to have fun. So have some fun! Taking your family, even the extended ones, on a seven-day cruise, buying large diamonds, or even buying a new car are things you can afford to do when you have millions of dollars. You can afford to do these things because when you do them, your money position is hardly even affected. If you like travel, travel. If you like clothes, buy some. I am releasing you to have some fun with your money, because money is to be enjoyed. That guilt-free enjoyment is one of the three reasons to have a Total Money Makeover.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Saving for a down payment or cash purchase of a home should occur after becoming debt-free in Step Two and after finishing the emergency fund in Step Three. That makes saving for a down payment Baby Step Three (b). You should save for the home if you have the itch before moving on to the next step. Many people are worried about getting a home, but please let it be a blessing rather than a curse. It will be a curse if you buy something while you are still broke. There are all sorts of folks who are eager to “work with you” so you can make it happen sooner, but the definition of “Creative Financing” is “Too Broke to Buy a House.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Here’s a Reader’s Digest version of my approach. I select mutual funds that have had a good track record of winning for more than five years, preferably for more than ten years. I don’t look at their one-year or three-year track records because I think long term. I spread my retirement, investing evenly across four types of funds. Growth and Income funds get 25 percent of my investment. (They are sometimes called Large Cap or Blue Chip funds.) Growth funds get 25 percent of my investment. (They are sometimes called Mid Cap or Equity funds; an S&P Index fund would also qualify.) International funds get 25 percent of my investment. (They are sometimes called Foreign or Overseas funds.) Aggressive Growth funds get the last 25 percent of my investment. (They are sometimes called Small Cap or Emerging Market funds.) For a full discussion of what mutual funds are and why I use this mix, go to daveramsey.com and visit MyTotalMoneyMakeover.com. The invested 15 percent of your income should take advantage of all the matching and tax advantages available to you. Again, our purpose here is not to teach the detailed differences in every retirement plan out there (see my other materials for that), but let me give you some guidelines on where to invest first. Always start where you have a match. When your company will give you free money, take it. If your 401(k) matches the first 3 percent, the 3 percent you put in will be the first 3 percent of your 15 percent invested. If you don’t have a match, or after you have invested through the match, you should next fund Roth IRAs. The Roth IRA will allow you to invest up to $5,000 per year, per person. There are some limitations as to income and situation, but most people can invest in a Roth IRA. The Roth grows tax-FREE. If you invest $3,000 per year from age thirty-five to age sixty-five, and your mutual funds average 12 percent, you will have $873,000 tax-FREE at age sixty-five. You have invested only $90,000 (30 years x 3,000); the rest is growth, and you pay no taxes. The Roth IRA is a very important tool in virtually anyone’s Total Money Makeover. Start with any match you can get, and then fully fund Roth IRAs. Be sure the total you are putting in is 15 percent of your total household gross income. If not, go back to 401(k)s, 403(b)s, 457s, or SEPPs (for the self-employed), and invest enough so that the total invested is 15 percent of your gross annual pay. Example: Household Income $81,000 Husband $45,000 Wife $36,000 Husband’s 401(k) matches first 3%. 3% of 45,000 ($1,350) goes into the 401(k). Two Roth IRAs are next, totaling $10,000. The goal is 15% of 81,000, which is $12,150. You have $11,350 going in. So you bump the husband’s 401(k) to 5%, making the total invested $12,250.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Winning at money is 80 percent behavior and 20 percent head knowledge.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Most people won’t change until the pain of where they are exceeds the pain of change.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“We are scaling down” is a painful statement to make to friends or family.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Debt is so ingrained into our culture that most Americans cannot even envision a car without a payment, a house without a mortgage, a student without a loan, and credit without a card. We”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“If you keep a $495 car payment throughout your life, which is “normal,” you miss the opportunity to save that money. If you invested $495 per month from age twenty-five to age sixty-five, a normal working lifetime, in the average mutual fund averaging 12 percent (the eighty-year stock market average), you would have $5,881,799.14 at age sixty-five. Hope you like the car!”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“The ARM, Adjustable Rate Mortgage, was invented in the early 1980s. Prior to that, those of us in the real estate business sold fixed-rate 7 or 8 percent mortgages. What happened? I was there in the middle of that disaster of an economy when fixed-rate mortgages went as high as 17 percent and the real estate world froze. Lenders paid out 12 percent on CDs but had money loaned out at 7 percent on hundreds of millions of dollars in mortgages. They were losing money, and lenders don’t like to lose money. So the Adjustable Rate Mortgage was born, in which your interest rate goes up when the prevailing market interest rates go up. The ARM was born to transfer the risk of higher interest rates to you, the consumer. In the last several years, home mortgage rates have been at a thirty-year low. It is not wise to get something that adjusts when you are at the bottom of rates! The mythsayers always seem to want to add risk to your home, the one place you should want to make sure has stability. Balloon mortgages are even worse. Balloons pop, and it is always strange to me that the popping sound is so startling. Why don’t we expect it? It is in the very nature of balloons to pop. Wise financial people always move away from risk, and the balloon mortgage creates risk nightmares.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“Being the highly trained investment mogul that I am, I could certainly find places to put that money where it would earn more. Or would it? Remember, personal finance is personal. I have come to realize that Sharon’s peace of mind bought with the oversized emergency fund is a great return on investment. Guys, this can be a wonderful gift to your wife. An Emergency Fund Can”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“There are some Baby Step Three clarifications. Joe asked recently if he should stop his Snowball—Step Two—to get his emergency fund finished. Joe and his wife have twins due in six months. Brad’s plant is closing in four months, and he will lose his job. Mike got a huge severance check of $25,000 last week when his company downsized him. Should these people work on debt or finish the emergency fund? All three should temporarily stop Snowballing and concentrate on the emergency fund because we can see distant storm clouds that are real. Once the storm passes, they can resume the plan as before. Resuming the plan for Joe means that once the babies are born healthy, are home, and everyone is fine, Joe will take the emergency fund back down to $1,000 by using the rest of the savings to pay the Debt Snowball. Resuming for Brad would mean that once he finds his new job, he’ll do the same. Mike should hold his instant emergency fund of $25,000 until he is reemployed. The sooner he can get a job, the more that severance is going to look like a bonus and have a huge impact on the Debt Snowball.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“At this stage in The Total Money Makeover, you are the Mr. Universe of Money, with serious abs, pecs, and quads. You have all this financial muscle, so now you should do something intentional with it. It is not just to look at. We built this financial superbody for a reason. To have FUN, INVEST, and GIVE.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“we buy things we don’t need with money we don’t have in order to impress people we don’t like.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“IF YOU WILL LIVE LIKE NO ONE ELSE, LATER YOU CAN LIVE LIKE NO ONE ELSE. This is the motto of your Total Money Makeover. It’s my way of reminding you that if you will make the sacrifices now that most people aren’t willing to make, later on you will be able to live as those folks will never be able to live.”

― Dave Ramsey, quote from The Total Money Makeover: A Proven Plan for Financial Fitness

“As I looked at her there among the pumpkins I was overcome with the color and the intesity of my life. In these moments we are driven to try and hoard happiness by taking photographs, but I know better. The improtant thing was what the colors stood for, the taste of hard apples and the existence of Lena and the exact quality of the sun on the last warm day in October. A photograph would have flattened the scene into a happy moment, whereas what I felt was rapture. The fleeting certainty that I deserved this space I'd been taking up on this earth, and all the air I had breathed.”

― Barbara Kingsolver, quote from Homeland and Other Stories

“We love our earth. We love our people. We love our stuff. We love our schedules. We love our short lives here. And God is saying, Look up. This is going fast. Your life here is barely a breath. There is more, way more. Time is almost gone. Our lives are only spent well on him and whatever stories he has written for us. What are we really so afraid of losing? Heaven feels far away, and we forget. But it is real . . . and it is coming.”

― quote from Anything: The Prayer That Unlocked My God and My Soul

“Anyone who is not on your same evolutionary and spiritual frequency will distance himself from you, while all those who are on the same evolutionary and spiritual frequency as you will come closer to you; you will see how amazing it is to discover that everyone who needs to be by your side will ultimately appear in your life in the most spontaneous and divine manner. That's how powerful the mind is”

― Ricky Martin, quote from Me

“Internet, automobiles, trains, planes, house, diets, clothes, gadgets and toys exceeded all our basic needs. Today, we tend to go beyond and above. ”

― quote from A Curious Mind: Foster Your Creative Potential For Better Life

“I call to mind flatness and dampness; and then all is madness - the madness of a memory which busies itself among forbidden things.”

― Edgar Allan Poe, quote from The Pit and the Pendulum (University Study Edition)

BookQuoters is a community of passionate readers who enjoy sharing the most meaningful, memorable and interesting quotes from great books. As the world communicates more and more via texts, memes and sound bytes, short but profound quotes from books have become more relevant and important. For some of us a quote becomes a mantra, a goal or a philosophy by which we live. For all of us, quotes are a great way to remember a book and to carry with us the author’s best ideas.

We thoughtfully gather quotes from our favorite books, both classic and current, and choose the ones that are most thought-provoking. Each quote represents a book that is interesting, well written and has potential to enhance the reader’s life. We also accept submissions from our visitors and will select the quotes we feel are most appealing to the BookQuoters community.

Founded in 2023, BookQuoters has quickly become a large and vibrant community of people who share an affinity for books. Books are seen by some as a throwback to a previous world; conversely, gleaning the main ideas of a book via a quote or a quick summary is typical of the Information Age but is a habit disdained by some diehard readers. We feel that we have the best of both worlds at BookQuoters; we read books cover-to-cover but offer you some of the highlights. We hope you’ll join us.