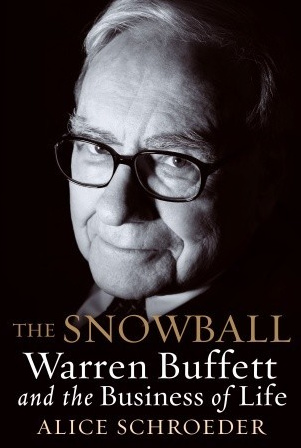

Alice Schroeder · 929 pages

Rating: (30.4K votes)

“On me personally what has been the most important was to understand the value of time -- and this is something that has come from observing him, learning his story and that time compounds. What you do when you are young (and as you use time over your life) can have an exponential effect so that if you are thoughtful about it, you can really have powerful results later, if you want to.

Also, that is a reason to be hopeful, because compounding is something that happens pretty quickly. If you are 50 or 60, it is not too late. He said to me one time, if there is something you really want to do, don't put it off until you are 70 years old. ... Do it now. Don't worry about how much it costs or things like that, because you are going to enjoy it now. You don't even know what your health will be like then.

On the other hand, if you are investing in your education and you are learning, you should do that as early as you possibly can, because then it will have time to compound over the longest period. And that the things you do learn and invest in should be knowledge that is cumulative, so that the knowledge builds on itself. So instead of learning something that might become obsolete tomorrow, like some particular type of software [that no one even uses two years later], choose things that will make you smarter in 10 or 20 years. That lesson is something I use all the time now.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Time is the friend of the wonderful business, the enemy of the mediocre.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Everybody wants attention and admiration. Nobody wants to be criticized. The sweetest sound in the English language is the sound of a person’s own name. The only way to get the best of an argument is to avoid it. If you are wrong, admit it quickly and emphatically. Ask questions instead of giving direct orders. Give the other person a fine reputation to live up to. Call attention to people’s mistakes indirectly. Let the other person save face.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“I feel like I’m on my back, and there’s the Sistine Chapel, and I’m painting away. I like it when people say, ‘Gee, that’s a pretty good-looking painting.’ But it’s my painting, and when somebody says, ‘Why don’t you use more red instead of blue?’ Good-bye. It’s my painting. And I don’t care what they sell it for. The painting itself will never be finished. That’s one of the great things about it.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“The Keoughs were wonderful neighbors,” he said. “It’s true that occasionally Don would mention that, unlike me, he had a job, but the relationship was terrific. One time my wife, Susie, went over and did the proverbial Midwestern bit of asking to borrow a cup of sugar, and Don’s wife, Mickie, gave her a whole sack. When I heard about that, I decided to go over to the Keoughs’ that night myself. I said to Don, ‘Why don’t you give me twenty-five thousand dollars for the partnership to invest?’ And the Keough family stiffened a little bit at that point, and I was rejected. “I came back sometime later and asked for the ten thousand dollars Clarke referred to and got a similar result. But I wasn’t proud. So I returned at a later time and asked for five thousand dollars. And at that point, I got rejected again. “So one night, in the summer of 1962, I started heading over to the Keough house. I don’t know whether I would have dropped it to twenty-five hundred dollars or not, but by the time I got to the Keough household, the whole place was dark, silent. There wasn’t a thing to see. But I knew what was going on. I knew that Don and Mickie were hiding upstairs, so I didn’t leave. “I rang that doorbell. I knocked. Nothing happened. But Don and Mickie were upstairs, and it was pitch-black. “Too dark to read, and too early to go to sleep. And I remember that day as if it were yesterday. That was June twenty-first, 1962. “Clarke, when were you born?” “March twenty-first, 1963.” “It’s little things like that that history turns on. So you should be glad they didn’t give me the ten thousand dollars.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Stocks are the things to own over time. Productivity will increase and stocks will increase with it. There are only a few things you can do wrong. One is to buy or sell at the wrong time. Paying high fees is the other way to get killed. The best way to avoid both of these is to buy a low-cost index fund, and buy it over time. Be greedy when others are fearful, and fearful when others are greedy, but don’t think you can outsmart the market. “If a cross-section of American industry is going to do well over time, then why try to pick the little beauties and think you can do better? Very few people should be active investors.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“gold standard,” which the United States had dropped in 1933. Ever since, the Treasury had been printing money freely to finance first the New Deal and now the war. Howard feared that someday the United States might wind up like Germany in the 1920s, when people had to cart wheelbarrows of money down the street to buy a head of cabbage—the direct result of Germany being forced to deplete its gold stock to pay reparations after World War I.1 The economic chaos that resulted was one of the major factors that had led to Hitler.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“I was in this Charlie Munger–influenced type transition—sort of back and forth. It was kind of like during the Protestant Reformation. And I would listen to Martin Luther one day and the Pope the next. Ben Graham, of course, being the Pope.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“He thought of partners as people who had come together out of a complex set of shared values and interests, not out of short-term economic convenience.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“The modern Berkshire Hathaway that he had created churned out new beads for the rosary almost like a clockwork. Buffett’s hunt for things to buy had become more ambitious, free of the cigar butts and lawsuits of the decades before. The great engine of compounding worked as a servant on his behalf, at exponential speed and under the gathering approval of a public gaze. The method was the same: estimate an investment’s intrinsic value, handicap its risk, buy using margin of safety, concentrate, stay in the circle of competence, let it roll as compounding did the work. Anyone could understand these simple ideas, but few could execute them. Even though Buffett made the process look effortless, the technique and discipline underlying it actually did involve an enormous amount of work for him and his employees. As”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“At age forty-seven, Warren had already accomplished everything he had ever imagined he could want. He was worth $72 million. He ran a company that was worth $135 million.41 His newspaper had won the two highest prizes in journalism. He was one of the most important men in Omaha and increasingly prominent at a national level. He was serving on the boards of the largest local bank, the Washington Post, and a number of other companies. He had been CEO of three companies and had bought and sold successfully more stocks than most people could name in a lifetime. Most of his original partners were now enormously rich. All he wanted was to keep on making money for the thrill of it without changing anything else about his life. He”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“The big question about how people behave is whether they’ve got an Inner Scorecard or an Outer Scorecard. It helps if you can be satisfied with an Inner Scorecard.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“He flaunted obnoxious feats of memory by quoting page numbers and passages back in class and correcting his teachers on their text citations.14 “You forgot the comma,” he said to one.15”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“You should never, when facing some unbelievable tragedy, let one tragedy increase into two or three through your failure of will,” he would later say.14”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“He added one catch: She must sign a noncompete agreement, a contract designed so that she could never again compete with him. This was something he wished he’d done before. The absurdity of imposing a noncompete agreement on a ninety-nine-year-old woman was far from lost on him. Nevertheless, Buffett was taking no chances.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Who’s my most valuable client?’ And he decided it was himself. So he decided to sell himself an hour each day. He did it early in the morning, working on these construction projects and real estate deals. Everybody should do this, be the client, and then work for other people, too, and sell yourself an hour a day.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Basically, when you get to my age, you'll really measure your success in life by how many of the people you want to have love you actually do love you.

I know people who have a lot of money, and they get testimonial dinners and they get hospital wings named after them. But the truth is that nobody in the world loves them. If you get to my age in life and nobody thinks well of you, I don't care how big your bank account is, your life is a disaster.

That's the ultimate test of how you have lived your life. The trouble with love it that you can't buy it. You can buy sex. You can buy testimonial dinners. You can buy pamphlets that say how wonderful you are. But the only way to get love is to be lovable. It's very irritating if you have a lot of money. You'd like to think you could write a check: I'll buy a million dollars' worth of love. But it doesn't work that way. The more you give love away, the more you get."

— Warren Buffett”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“if you thought of yourself as having a card with only twenty punches in a lifetime, and every financial decision used up one punch. You’d resist the temptation to dabble. You’d make more good decisions and you’d make more big decisions.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“allies are essential; that commitments are so sacred that by nature they should be rare; and that grandstanding rarely gets anything done.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“When Warren was a little boy fingerprinting nuns and collecting bottle caps, he had no knowledge of what he would someday become. Yet as he rode his bike through Spring Valley, flinging papers day after day, and raced through the halls of The Westchester, pulse pounding, trying to make his deliveries on time, if you had asked him if he wanted to be the richest man on earth—with his whole heart, he would have said, Yes.

That passion had led him to study a universe of thousands of stocks. It made him burrow into libraries and basements for records nobody else troubled to get. He sat up nights studying hundreds of thousands of numbers that would glaze anyone else’s eyes. He read every word of several newspapers each morning and sucked down the Wall Street Journal like his morning Pepsi, then Coke. He dropped in on companies, spending hours talking about barrels with the woman who ran an outpost of Greif Bros. Cooperage or auto insurance with Lorimer Davidson. He read magazines like the Progressive Grocer to learn how to stock a meat department. He stuffed the backseat of his car with Moody’s Manuals and ledgers on his honeymoon. He spent months reading old newspapers dating back a century to learn the cycles of business, the history of Wall Street, the history of capitalism, the history of the modern corporation. He followed the world of politics intensely and recognized how it affected business. He analyzed economic statistics until he had a deep understanding of what they signified. Since childhood, he had read every biography he could find of people he admired, looking for the lessons he could learn from their lives. He attached himself to everyone who could help him and coattailed anyone he could find who was smart. He ruled out paying attention to almost anything but business—art, literature, science, travel, architecture—so that he could focus on his passion. He defined a circle of competence to avoid making mistakes. To limit risk he never used any significant amount of debt. He never stopped thinking about business: what made a good business, what made a bad business, how they competed, what made customers loyal to one versus another. He had an unusual way of turning problems around in his head, which gave him insights nobody else had. He developed a network of people who—for the sake of his friendship as well as his sagacity—not only helped him but also stayed out of his way when he wanted them to. In hard times or easy, he never stopped thinking about ways to make money. And all of this energy and intensity became the motor that powered his innate intelligence, temperament, and skills.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Be fearful when others are greedy, and greedy when others are fearful.” This was the time to be greedy.33”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine,” Buffett said. “So if you had your choice, if you could put a hundred million dollars into a business that earns twenty percent on that capital—twenty million—ideally, it would be able to earn twenty percent on a hundred twenty million the following year and on a hundred forty-four million the following year and so on. You could keep redeploying capital at [those] same returns over time. But there are very, very, very few businesses like that...we can move that money around from those businesses to buy more businesses.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“There are two ideas of government. There are those who believe that if you just legislate to make the well-to-do prosperous, that their prosperity will leak through on those below. The Democratic idea has been that if you legislate to make the masses prosperous their prosperity will find its way up and through every class that rests upon it.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Remember one thing, Warren: Money isn’t making that much difference in how you and I live. We’re both going down to the cafeteria for lunch and working every day and having a good time. So don’t worry too much about money, because it won’t make much difference in how you live.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“I had these Whitman coin boards with slots for the coins. I said to Don, ‘It looks to me like we could take these coin boards and use them as molds for casting slugs.’ “Danly was the brains of the operation. And so, sure enough, he learned how to pour these molds for casting slugs, and I supplied the coin boards. We would try to use the slugs for vending machines for soda pop and things like that. Our basic formula was to have our income in currency and our outgo in slugs.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Lose money for the firm, and I will be understanding. Lose a shred of reputation for the firm, and I will be ruthless.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“The Buffetts followed the trail blazed by earlier SUVs a few miles onward from the airport to the tiny town of Ketchum, near the turnoff to the Elkhorn Pass. A few miles later, they rounded Dollar Mountain, where a green oasis appeared, nestled among the brown slopes. Here amid the lacy pines and shimmering aspens lay Sun Valley, the mountains’ most fabled resort.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“The big question about how people behave is whether they’ve got an Inner Scorecard or an Outer Scorecard. It helps if you can be satisfied with an Inner Scorecard. I always pose it this way. I say: ‘Lookit. Would you rather be the world’s greatest lover, but have everyone think you’re the world’s worst lover? Or would you rather be the world’s worst lover but have everyone think you’re the world’s greatest lover?’ Now, that’s an interesting question.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“Praise by name, criticize by category.”

― Alice Schroeder, quote from The Snowball: Warren Buffett and the Business of Life

“window of respite before he rose. She”

― Amanda Prowse, quote from The Food of Love

“I would have done anything to stop the hitting. Anything. So much for human dignity, I think, a few whacks in the ribs and you’re calling a fat guy God and eating soil at his request.”

― George Saunders, quote from CivilWarLand in Bad Decline

“There is something to be said for the night. The darkness holds a sense of promise, as if anything could happen. Maybe something good, like a handsome stranger or something with snarling teeth that whispers pretty things as it eats you. Thus, the night is a test. A test of fear and the sweet promise of pain.”

― Meg Collett, quote from Fear University

“The road to hell is paved with unbought stuffed animals”

― Ernest Hemingway, quote from Fiesta

“After expressing his appreciation that his glass is half full rather than being completely empty, he will go on to express his delight in even having a glass: It could, after all, have been broken or stolen.”

― William B. Irvine, quote from A Guide to the Good Life: The Ancient Art of Stoic Joy

BookQuoters is a community of passionate readers who enjoy sharing the most meaningful, memorable and interesting quotes from great books. As the world communicates more and more via texts, memes and sound bytes, short but profound quotes from books have become more relevant and important. For some of us a quote becomes a mantra, a goal or a philosophy by which we live. For all of us, quotes are a great way to remember a book and to carry with us the author’s best ideas.

We thoughtfully gather quotes from our favorite books, both classic and current, and choose the ones that are most thought-provoking. Each quote represents a book that is interesting, well written and has potential to enhance the reader’s life. We also accept submissions from our visitors and will select the quotes we feel are most appealing to the BookQuoters community.

Founded in 2023, BookQuoters has quickly become a large and vibrant community of people who share an affinity for books. Books are seen by some as a throwback to a previous world; conversely, gleaning the main ideas of a book via a quote or a quick summary is typical of the Information Age but is a habit disdained by some diehard readers. We feel that we have the best of both worlds at BookQuoters; we read books cover-to-cover but offer you some of the highlights. We hope you’ll join us.